Fuel COVID-19 Consumer Sentiment Study Volume 3: Hope is on the Horizon

by Melissa Kavanagh

Given the sample size for these surveys, this report constitutes one of the most thorough and comprehensive reports on consumer sentiment. We hope that you find the information useful. The survey was sent out on April 30, 2020, and received more than 10,000 responses. Below is a summary of the findings, along with some observations and opportunities that arise from the results. The first study can be found here and the second one is here.

Executive Summary

There were very few changes overall compared to the last survey, indicating that consumers are settling into the new normal. Below are the highlights:

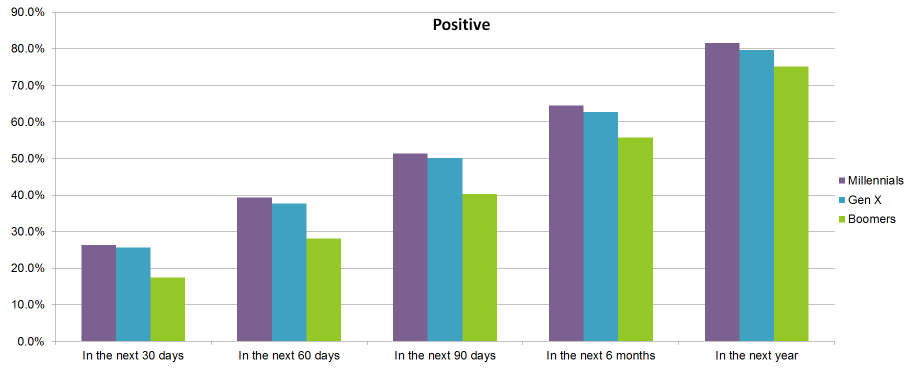

- Age matters.

- Millennials consistently answered that they will be more willing to travel sooner than Gen X and Boomers, and are less risk-averse

- Millennials will also spend less compared to other generations

- Income matters…but not always.

- Not surprisingly, those in lower income brackets are likely to spend less than they have in the past, with shorter stays, and more affordable properties.

- There was no significant difference between income levels spending stimulus money on vacations.

- Nor was there any difference in the percentage of people saying discounts could persuade them to book now.

- Distance and location matter. The data has been extremely consistent in showing that less densely populated locations, and those within a few hours drive from home are more likely to be visited within the first 3 months of restrictions being lifted.

- Hope is on the horizon. When asked for one word to describe traveling now, we saw more positive phrases like, “ready,” “excited,” “freedom,” and “hopeful.”

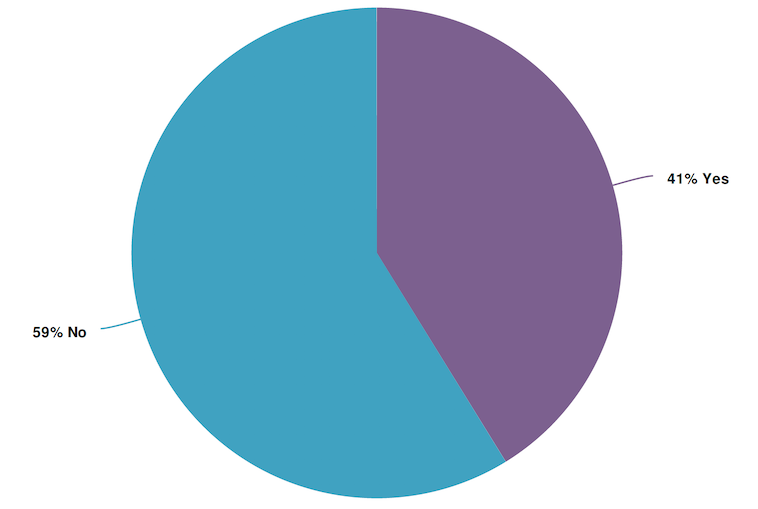

1. Have you had a trip affected by the coronavirus outbreak?

- Observation: 60% of respondents have either canceled or rescheduled a trip. This is down from nearly 70% 2 weeks ago.

- Data Comparison: Those saying no increased from 35% to 41%.

- Opportunity: A large number of people have yet to cancel a future trip. Being proactive with these guests by reaching out and offering to reschedule for free would potentially reduce the risk of losing these guests altogether. We have also seen success from properties who call the canceled guests and offer to rebook them with added incentives and a no-risk cancellation policy.

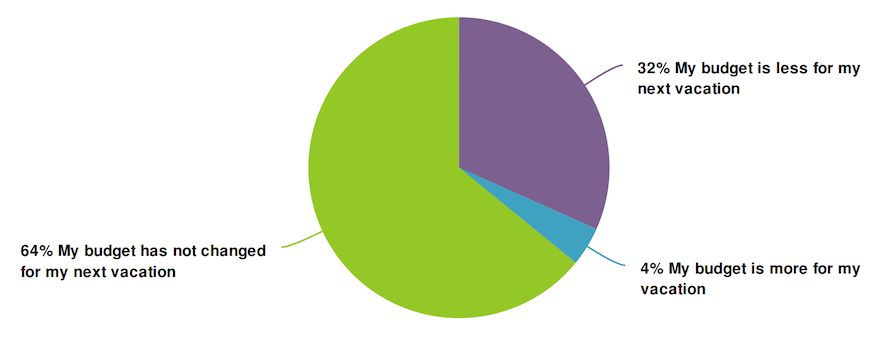

2. As a result of the coronavirus situation, which best describes you?

- Observation: 64% claim that their budget for travel is unchanged, while 32% say that it’s reduced.

- Data Comparison: There is no change since last survey.

- Age Insight: 36% of millennials and gen X will spend less, 5% will spend more; Boomers only 28% will spend less, 4% will spend more.

- Income Insight: Only 22% of >$100K said budget will be less, 73% was unchanged. 43% of <$50K will spend less, and 53% unchanged.

- Opportunity: Know your consumer. Younger people, in addition to those in lower income brackets are going to be more price-sensitive. Providing value-added packages will increase the chance of persuading those who are in the more price-sensitive category.

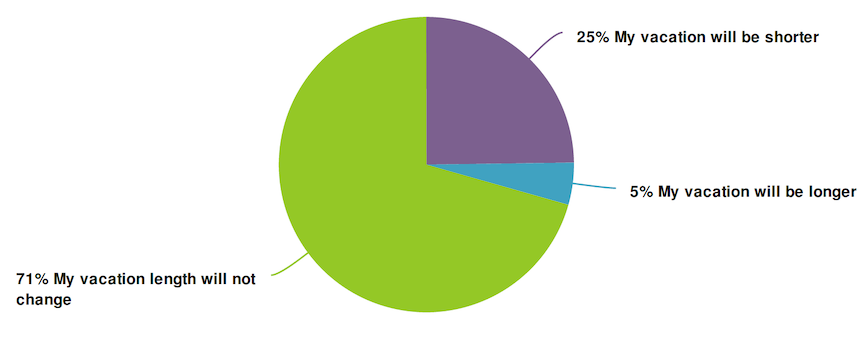

3. How will coronavirus likely affect the length of stay for your next vacation?

- Observation: Less than 30% said that their length of stay would be affected at all. However, most of those that are likely to change their stays, will be staying for a shorter length of time.

- Data Comparison: Data has not changed since the last survey

- Income Insight: Not surprising, more of those in the <$50K category will plan on shorter stays, at 33%, vs. 25% for $50K-100K, and 17% for >$100K.

- Opportunity: By offering both longer and shorter package pricing, you will increase the chance of converting both types of travelers.

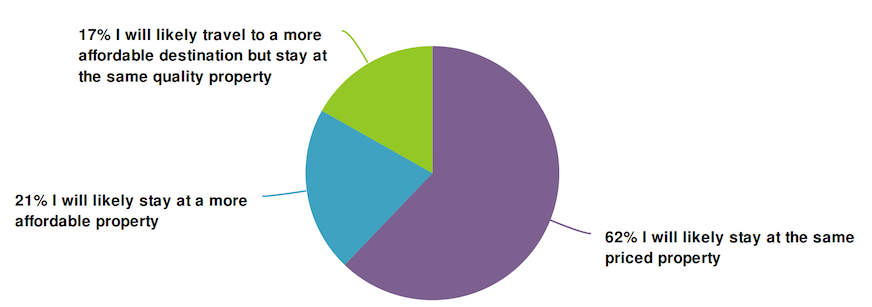

4. How will coronavirus likely affect the type of property you choose for your next vacation?

- Observation: With 30% of people saying they will be spending less on their vacation, it is not surprising that 21% answered that they will likely stay at a more affordable property.

- Data Comparison: There is no change compared to last survey

- Age Insight: 28% of millenials will stay at a more affordable property

- Income Insight: 29% of <$50K will stay at a more affordable property, 72% of >$100K will stay in the same priced property, and 14% more affordable property and more affordable destination

- Opportunity: Again, any type of added value that can be included in a stay will help persuade these potential guests. Gift cards for gas, 2 breakfasts included per stay, Starbucks gift card or free coffee from your on-site coffee shop are examples of a few low-cost items.

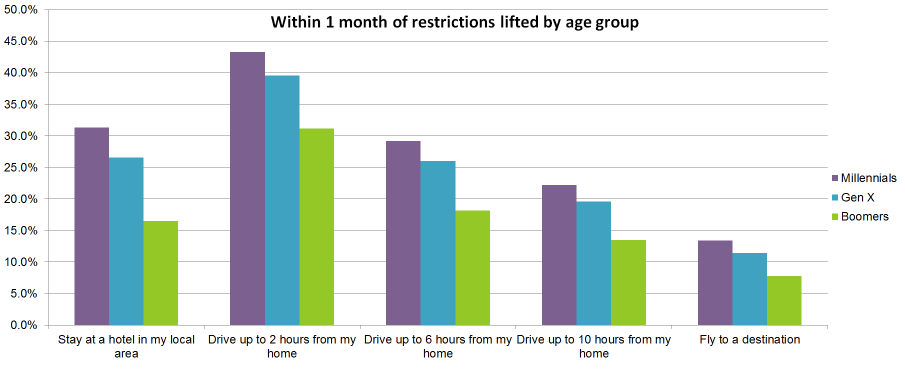

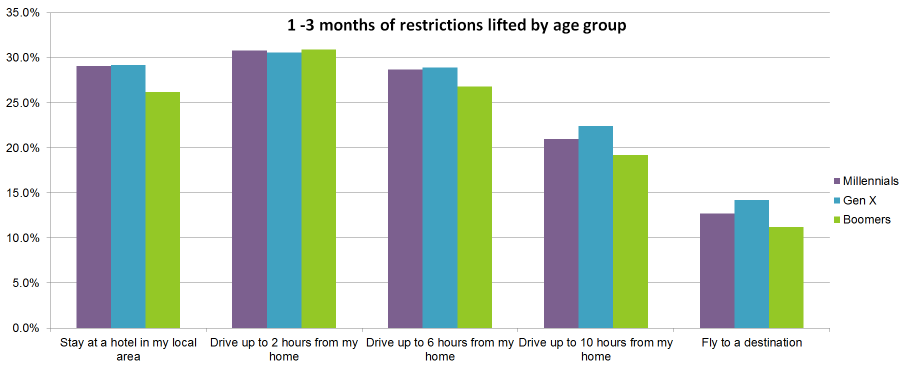

5. How soon after the restrictions are lifted will you be willing to

make the following trips?

Age Insight: Millennials are ready to get traveling much sooner than older generations. Gen X is not quite as daring, but still likely to travel sooner than Boomers

- Observation: For distances of driving up to 2 hours, 66% of consumers will be ready to travel within 3 months of restrictions being lifted. 36% would be willing to travel within 1 month vs. 31% in the 1-3 month window. Staying local and driving up to 6 hours was just under 50% within 3 months, and flying comprised just 22%.

- Data Comparison: In every category, the percentage of people saying they would travel within 1 month and 1-3 months decreased by 1-2 percentage points. This would indicate that there has been an increase in uncertainty

- Income Insight: >$100K are more willing to fly within 12 months at 69%, vs. 53% <50K and 59% for 50-100K.

- Geo Insight: Hot spot respondents slightly less likely to stay locally within 1 month, at 18%. More likely to fly than overall population within a year at 66% vs. 59%. The overall data is more alike than we would expect.

- Opportunity: The 2 hour drive market is the most confident for traveling sooner rather than later, with 36% ready to travel within a month of restrictions being lifted, and 31% from 1-3 months. For the near future, targeting these consumers via email and paid search will yield the best returns.

- Resource: Fuel has developed A How-To Guide For Targeting Drive Markets

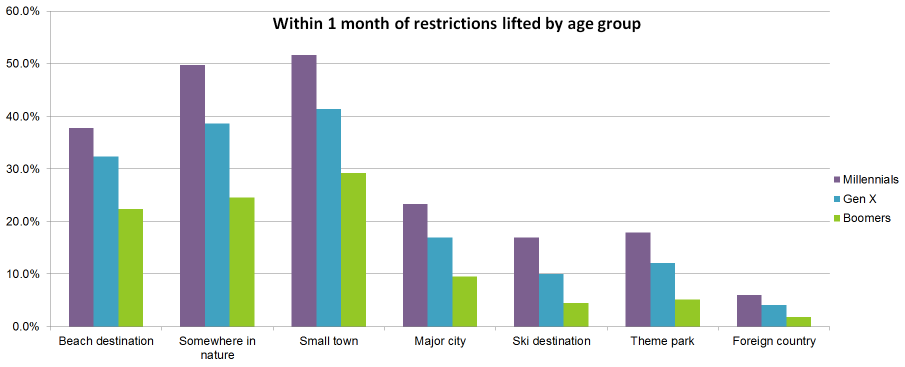

6. How soon after the restrictions are lifted will you be willing to travel to the following types of destination?

Age Insight: Millennials will be traveling sooner to all types of destinations within 30 days. The gap shrinks for open area spaces in 1-3 months, but is still substantial in densely populated destinations.

- Observation: Destinations with opens spaces are still more likely to be visited earlier than densely populated areas, ski destinations, or foreign travel.

- Data comparison: Somewhere in nature and small towns had small increases within 1 month. Beach destinations had small decreases in both 1 month and 1-3 months. Theme parks have decreased even further in the 1-3 months, going from 14% to 12%.

- Geo Insight: Surprisingly, there was little difference for hot spot respondents.

- Opportunity: Even with the small decrease in confidence 0-3 months from restrictions lifting, open area destinations should still expect summer bookings. For major cities, even though the numbers are smaller within the first 3 months, it’s still 34% of respondents. Using smart targeting will prove to have the best results.

- Resource: Take a look at your analytics for insight as to what your consumer is looking for vs. booking. What COVID-19 Means for Your Analytics Data

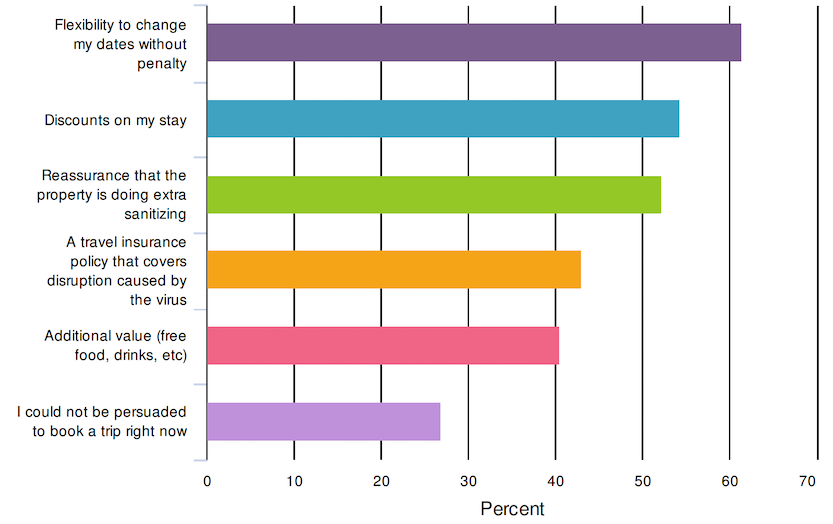

7. Which of the following would most likely persuade you to book a future vacation during the coronavirus outbreak? (Check all that apply)

- Observation: More than 60% of people chose flexibility to change without penalty, and more than 43% chose travel insurance.

- Data Comparison: People saying that they could not be persuaded decreased again from 29% to 27%. Flexibility to change increased from 58% to 62%, and travel insurance increased from 41% to 43%. Discounts and added value showed increases, as well as reassurance of sanitizing. These have all been moving in a positive direction since the first study.

- Age Insight: Millennials are even more concerned about flexibility – 71%. Only 16% could not be persuaded vs. 32% of boomers.

- Income Insight: Surprisingly not a big difference of those who could not be persuaded, nor for discounts.

- Opportunity: Clearly stating your cancellation policy and safety efforts, as well as any changes you have made to it in all marketing efforts is critical.

- Resource: Fuel put this article together on what types of policy changes and messaging you should be implementing right now: The Definitive Guide To COVID19 Policy Updates & Communication

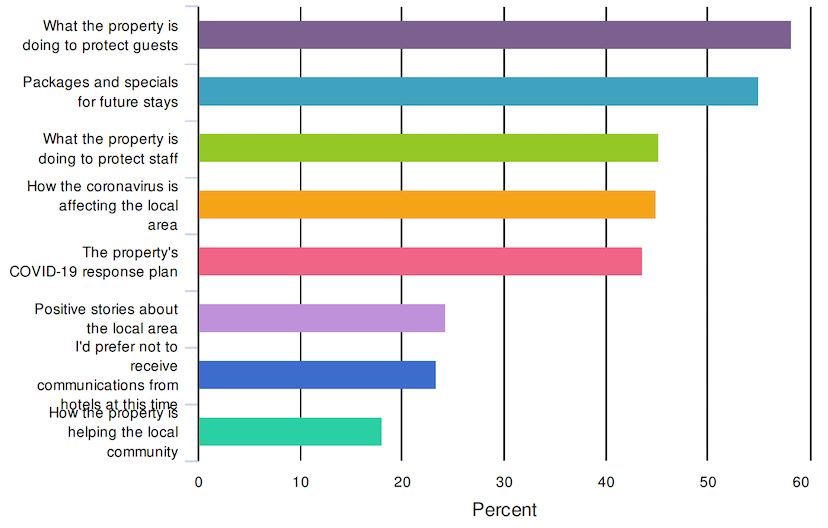

8. During the outbreak, I would like to hear from hotels on the following topics: (check all that apply)

- Observation: Respondents are MORE interested in learning about what properties are doing to protect guests as they are about receiving deals for future stays. They are also interested in safety regarding the staff, what is happening in the local area, and the property’s COVID-19 response plan.

- Opportunity: By proactively messaging your guest database with important information on their safety AND that provides value to them, and shows empathy, you can keep your property top of mind. Being in communication with your guest during this time increases your chances of earning bookings as recovery picks up.

- Data Comparison: More than 75% of all respondents are STILL saying that would like to receive communication from hotels. Those choosing what the property is doing to protect guests increased from 53% to 58%, while learning about packages remained steady at 55%.

- Resource: Here are some great examples of the types of messages that properties are pushing out right now: Coronavirus: Examples of Hotel Messaging Done Right

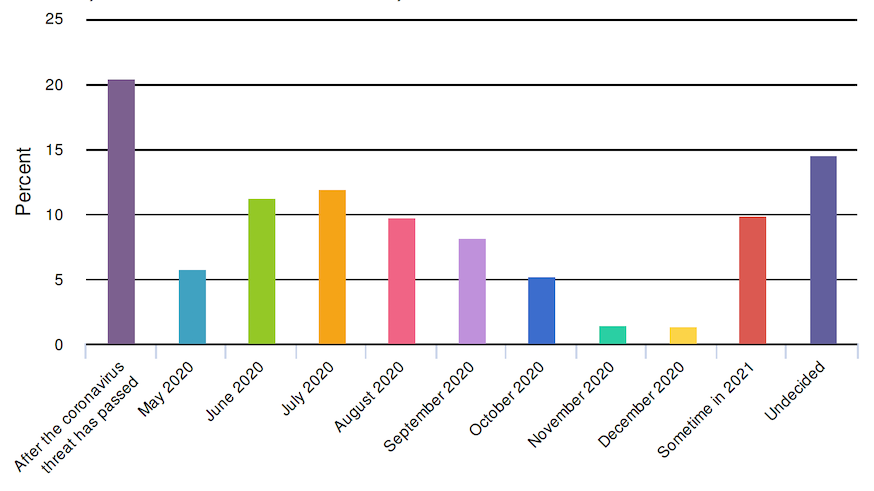

9. When do you intend to BOOK your future vacation? & When do you intend to TRAVEL for your future vacation?

- Observation: For booking, 23% said after the virus has passed, 19% were undecided. Sometime in 2021 was chosen by 8%. Of those that chose a 2020 date, June was most popular, at 11%, followed by May at 11%.

- For traveling, 14% were undecided. June and July were the most popular answer of those that chose a date, at 11% and 12%, respectively.

- Data Comparison: For booking, “after the threat has passed” responses shrunk again from 35% to 23%, with May, June and July picking up the most traction. For travel, this response also decreased dramatically from 31% to 21%.

- Geo Insight: For booking, hot spots responded with 28% after virus has passed vs. 22% overall.

- Income Insight: For traveling, 17% of >$100K chose after virus has passed, vs. 23% <$50K, and 19% $50-100K

- Opportunity: The significant decrease in those choosing to not make a decision until after the virus has passed could indicate the confidence that the pandemic is passing is increasing. Sending clear messaging about your property’s cancellation policies and safety procedures can help consumers be persuaded to book.

- Resource: We’ve put together a crisis recovery checklist to help guide you.

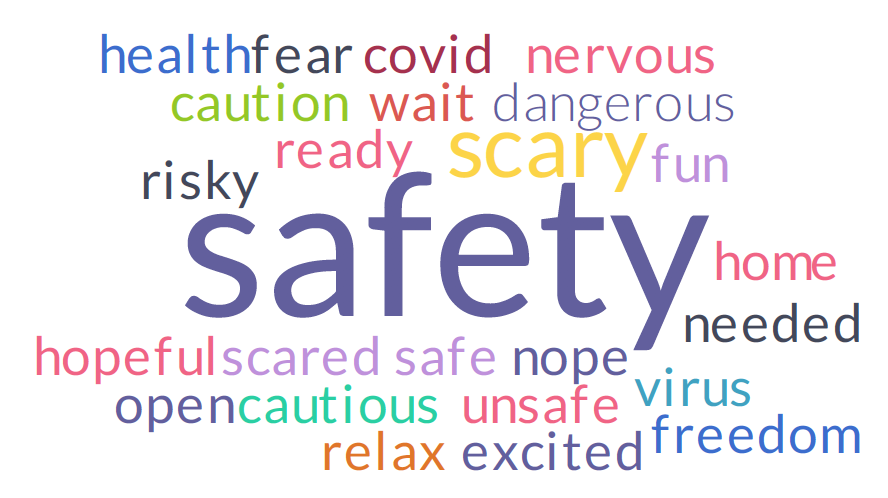

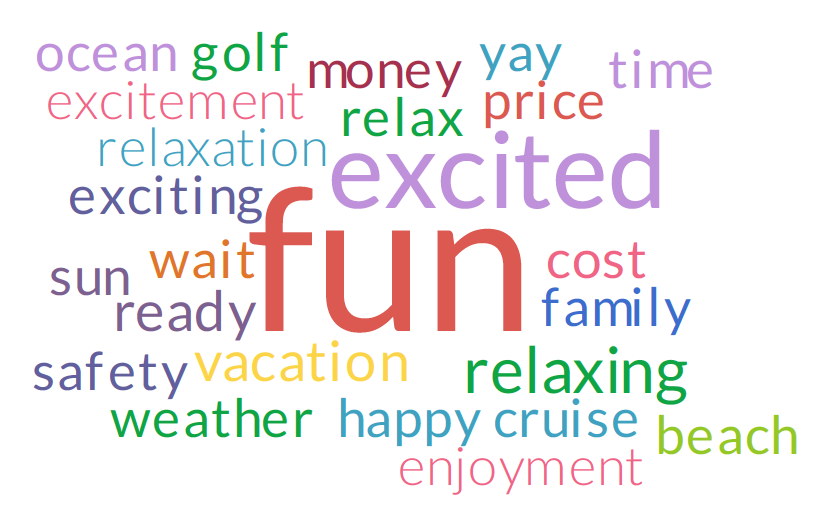

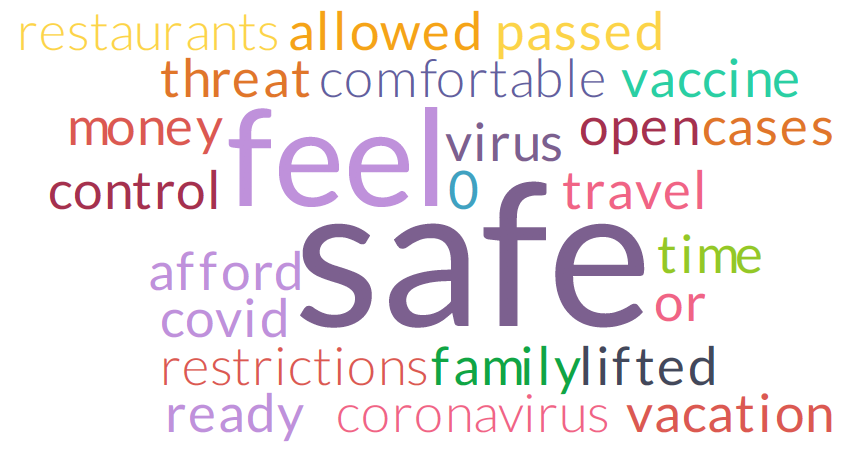

10. What is the first word that you think of when considering travel right now? & Before the coronavirus outbreak?

- Observation: For right now, there are still almost no positive words appearing at all on this list. Safety and scary were the top words, again. This is a huge change from pre-outbreak, where fun and excited were the most popular statements.

- Data Comparison: “Hopeful” was on the last 2 surveys, but has not grown in size. New to this set of results is “excited,” “ready,” and “freedom.” These are clear indications that people are starting to feel the effects of the restrictions of this pandemic.

- Opportunity: People will remember how you make them feel during this crisis. People are uncertain of the future and are concerned for their safety now. What can you do to ease those sentiments? Can you bring some fun and excitement to them now?

11. Complete the following sentence: I will travel when:

- Observation: Again, safety is most prevalent.

- Data Comparison: “Restaurants” was a new response in this survey round. “Money” and “afford” were also new. This is an indication that fear is beginning to decrease and people are beginning to prioritize other factors.

- Opportunity: As mentioned before, whatever you can do to assure visitors that you have their well-being as a priority will increase your chance in convincing them to stay with you. Messaging around your restaurant should be included in your list. Being cognizant of the financial stress many people are feeling, and providing value-add items to packages where possible will help consumers feel more comfortable booking.

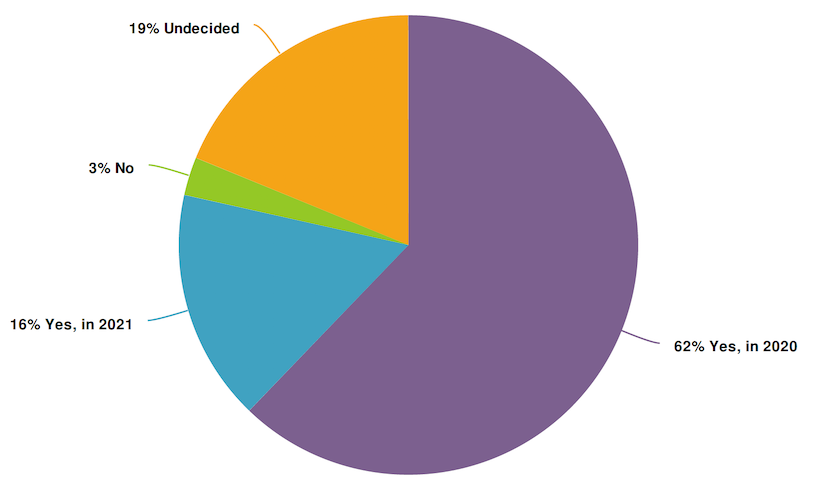

12. Do you still intend to take a vacation in 2020 or 2021?

- Observation: With 62% saying yes in 2020 and 16% saying yes in 2021, consumers have not lost the desire to vacation. Only 3% said that they had no desire to take a vacation.

- Data Comparison: Those saying yes to 2020 decreased from 65% to 62%, 2021 increased from 14% to 16%, and no increased from 2% to 3%.

- Income Insight: All 3 income levels responded 16% in 2021, and 2-3% no. Undecided decreased with each income level from 22% to 14%.

- Geo Insight: 59% of hot spots responded in 2020, 21% in 2021. This shows that more people located in hot spots are wanting to wait out the storm before traveling than the average respondent.

- Opportunity: With more than 60% of consumers saying that they are intending to take a vacation in 2020, keeping your property top of mind now is imperative, so that people will think of you when they are ready to make travel plans.

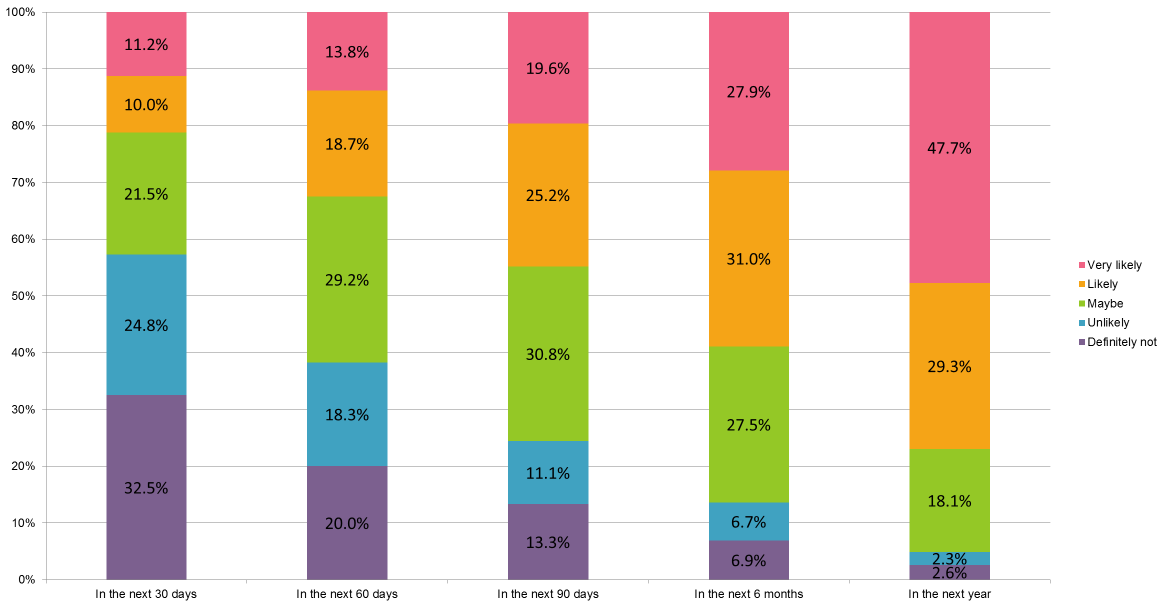

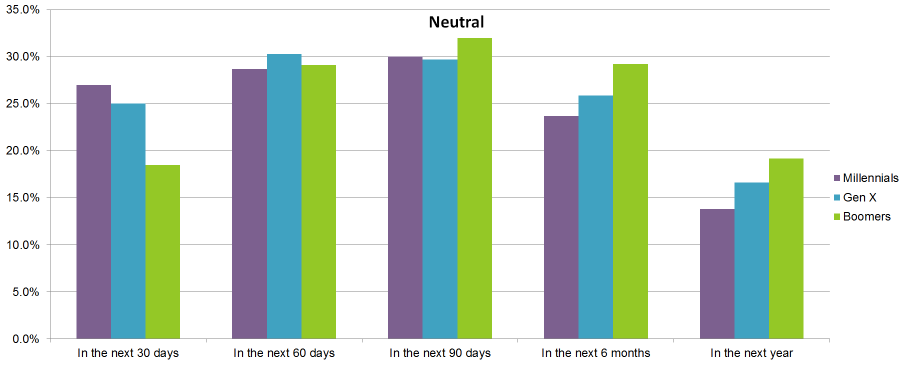

13. How likely are you to book a trip:

Age Insight: Boomers are much more adverse to traveling at all than younger generations, but especially within the next 60 days.

- Observation: There is low confidence to book a trip in the next 30 days, with 34% responding “maybe” or higher, but 62% within 60 days, and 76% within the next 90 days.

- Data Comparison: Those answering in the next 30 days decreased from 38% to 34%, while 60 days increased from 59% to 62%.

- Geo Insight: Hot spots showed 57.5% very likely to travel within 0-60 days vs. 72.5% for all respondents

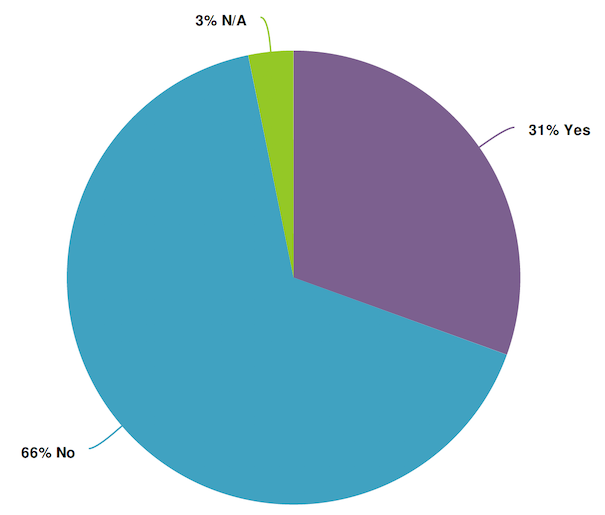

14. Have you already booked your future stay?

- Observation: 31% of people do have an upcoming stay, 66% do not.

- Income Insight: 73% of <$50K respondents said no, vs. 65% for $50-100K, and 61% >$100K

- Opportunity: Coupling this response with the previous insight suggests that many people could be persuaded to book within 60 days. Lower priced properties have an even better chance to convert visitors, since more lower income brackets have not yet booked.

15. If you have stayed at a specific property before and you knew it was struggling financially, would you be willing to do any of the following to help? (Check all that apply)

- Observation: Over 90% said they would book a future stay as long as they could change or cancel with no penalty! 18% would be willing to pre-pay for a future stay and select dates later.

- Data Comparison: No change from previous survey.

- Opportunity: A focus on future stays is a logical conclusion, but don’t forget that those who have stayed with you in the past can be your best advocates. Utilize your social media platforms and consumer advocacy platforms like flip.to to have your guests share past experiences, encouraging their friends and family to consider your property as they plan their vacations too.

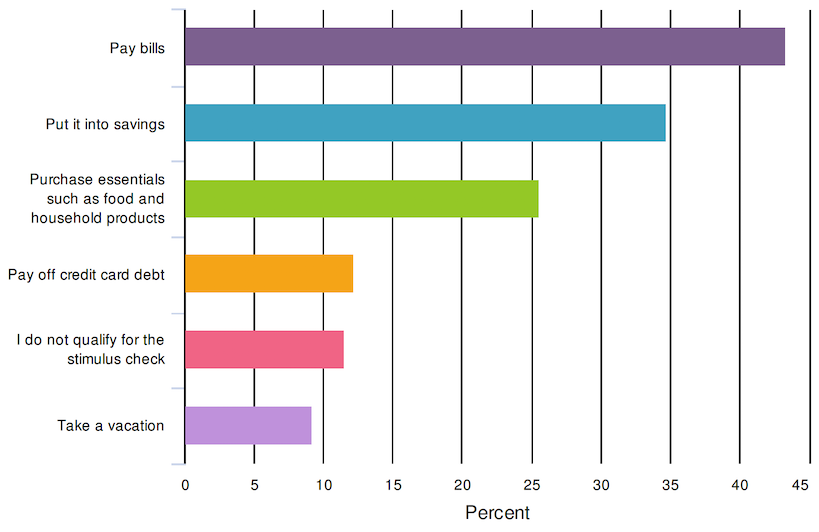

16. The government is sending every American a stimulus check to help during the coronavirus crisis. How do you intend to spend your stimulus check?

- Observation: Very few people (<10%) are considering spending their stimulus check on travel at this time. The majority of people are looking at paying bills (~43%), putting it into savings (34%), or buying essentials (26%).

- Data Comparison: Paying bills saw an increase from 41% to 43%, while savings decreased.

- Income Insight: While the percentage of >$100K that did not qualify for the stimulus check is higher than the other groups, there is no substantial difference in willingness to spend money on a vacation.

- Opportunity: Many people are feeling the financial strain this pandemic, with unemployment filings reaching astronomical levels for the last few weeks. Keeping in mind that money will be tight for people for some time, there should be a focus on adding value to your packages. Look at incorporating things like free upgrades and food and beverage credits to encourage people to stay with you and help their pennies stretch further.

What's Next?

The bottom line of this round of survey data is that very little has changed in the last 2 weeks. Older generations are more skeptical of traveling, especially in the near future. This could be an indication that people are starting to settle into “the new normal.” Lower income families are seeing more of a strain on their budgets and will likely book shorter and more affordable properties. We will continue these studies, sampling the same database every two weeks to see when there is a notable shift in sentiment.

In the meantime, check out our COVID-19 and crisis management resources here.

Survey Methodology

This was a self-reporting survey sent to a database of leisure travelers located in North America. Questions containing multiple checkbox responses had the options randomized to avoid positional bias. Over 10,000 people participated in the survey, with over 7,600 completing all questions. Below are the demographic breakdown of respondents.

Age & Gender:

Do you have children living at home with you?

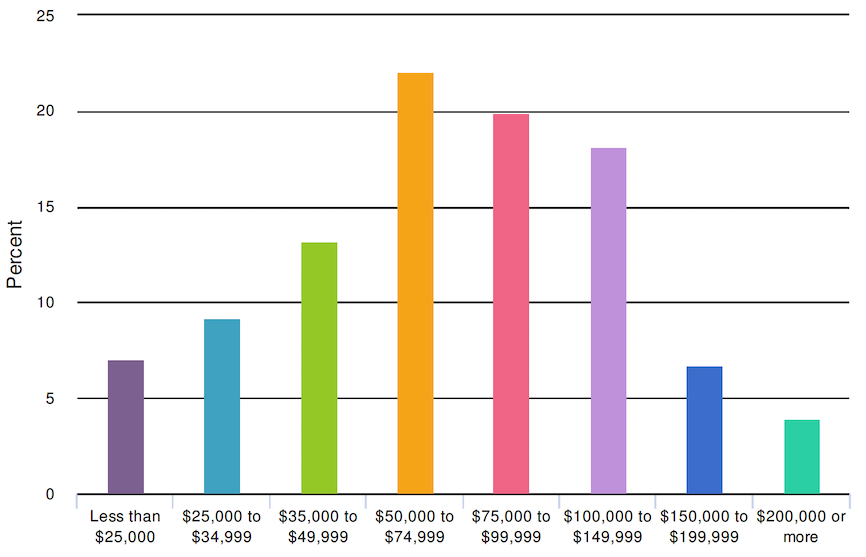

What was your total estimated household income before taxes during the past

12 months?