Fuel COVID-19 Consumer Sentiment Study Volume 10: Have We Reached The New Normal?

by Melissa Kavanagh

This is the 10th edition of Fuel’s COVID-19 Consumer Sentiment Study. As the virus continues to impact the state of travel and the hospitality industry, we want to continue to provide insights on the sentiment of consumers.

We hope that you find the information useful. The survey was sent out on September 17, 2020, and received 900 responses. Below is a summary of the findings, along with some observations and opportunities that arise from the results.

Executive Summary

Little has changed since our last survey, with travel confidence nearly at the level we had seen in June. We have continued to ask new questions to those who have traveled during the pandemic. Below are the key points of this survey.

- More than half of the respondents have traveled since the pandemic, and most have traveled more than once.

- Of those who have traveled, more than 40% booked within 2 weeks of the trip.

- Communication to guests about the status of local restaurants, attractions and activities continues to be sub-par.

- There yet another shift in sentiment about mask ordinances, with more people saying that a mask ordinance would make them MORE likely to go to a destination.

- Open air destinations and 1-3 hour drive locations are still far more likely to be visited in the near future.

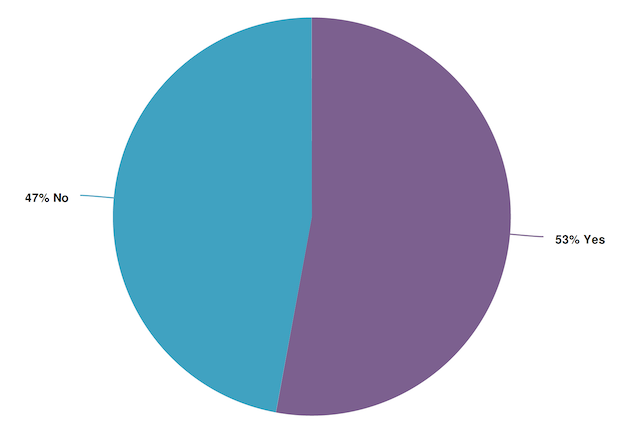

1. Have you traveled since March 15th, 2020?

- Observation: 53% of respondents have not traveled since COVID-19 was declared a pandemic!

- Data Comparison: In our last survey, 50% of respondents had traveled, which was an increase from 34% on the previous round.

The next six questions were only asked to people who responded “yes“ to the previous question.

2. How many trips have you taken since March 15th 2020?

- Observation: While nearly 45% of respondents had traveled once, the majority of respondents have actually traveled more than once.

- Opportunity: With 56% of people saying that they have traveled at least twice since the pandemic, what can you do to get your guests to come back again?

- Resource: BE the hunter hotelier: The Hunter Hotelier: Driving Their Own Demand & Succeeding In Today’s Market

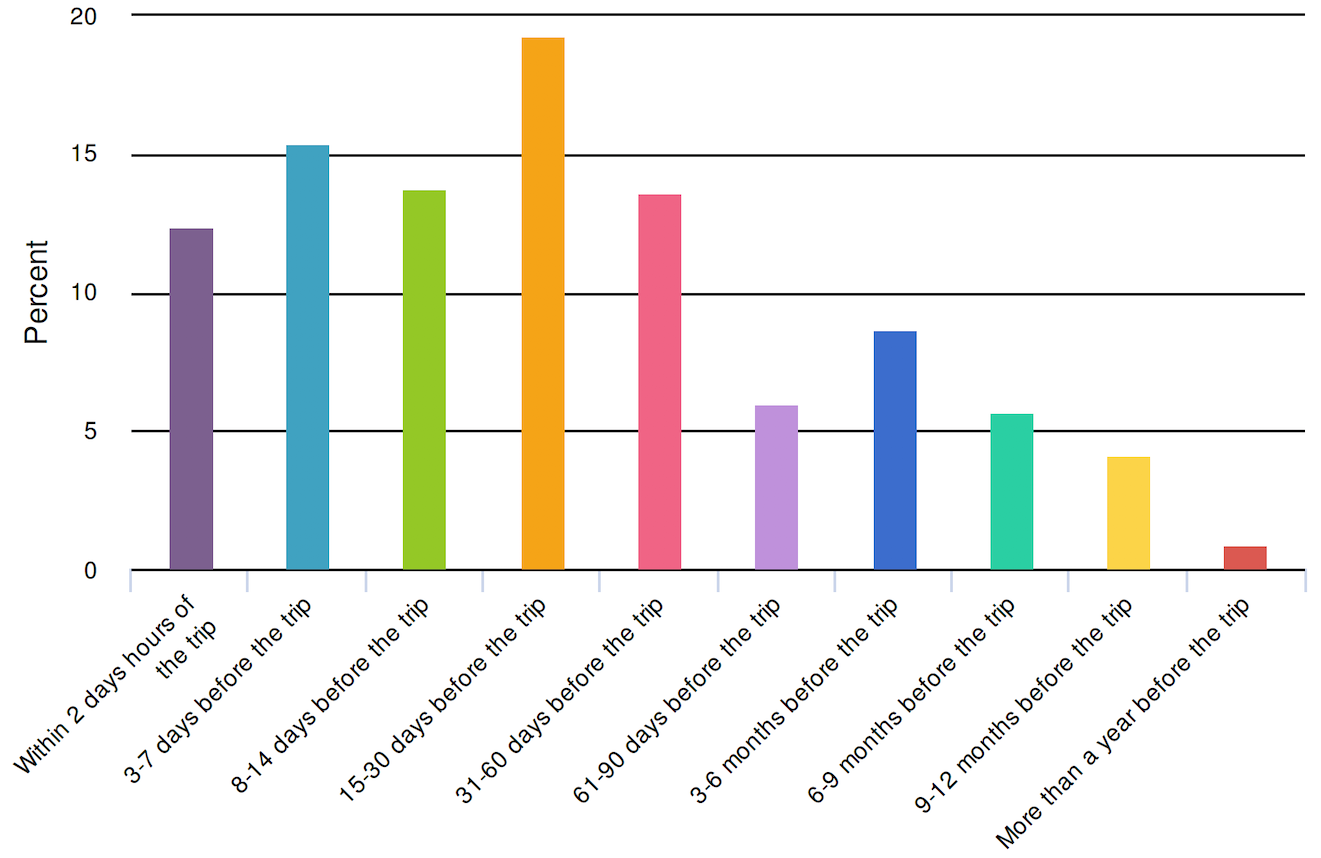

3. For your most recent trip, how far in advance did you make your reservation?

- Observation: Answers were quite diverse, however 15-30 days ahead was most popular, with nearly 20% of responses. The three categories up to 14 days, combined, make up 42% of responses.

- Opportunity: Consumers are booking trips within short time-spans of arrival. Targeting potential guests with last-minute deals could be a great opportunity.

4. What was the reason for your recent trip?

- Observation: More than 70% responded with vacation as their reason from traveling.

5. During your recent trip, where did you stay?

- Observation: Nearly 60% said they stayed at a hotel-type property. No other property types came remotely close to the popularity of hotels.

6. Did the property communicate the following to you prior to your recent stay?

- Observation: 72% of respondents said that they received communication regarding cleaning protocols at the property, and nearly 70% for local mask requirements. Properties are not communicating well the status of local restaurants or attractions/activities. Only 25% knew the status of local attractions before arriving.

- Data Comparison: The only significant shift since the last survey, is the increase in those responding with local mask requirements, going from 59% to 68%.

- Opportunity: You can, and should be, a great source of information as it pertains to your local area. Always have updated information on your website and in all communication to guests on the status of restaurants and local attractions. Remember that the hotel room is just one part of a guest’s vacation.

7. Did the property meet your expectations in the following areas?

- Observation: Great news for hoteliers! In every area, an overwhelming majority of respondents said their expectations were met or exceeded! The two areas with the most dissatisfaction continue to be social distancing enforcement (12%) and availability of amenities (15%).

- Data Comparison: There was no significant shift in this data since our last survey.

8. The next time you travel, which of the following would you want the property tocommunicate to you prior to your stay?

- Observation: 75% of respondents want to know local mask requirements, closely followed by cleaning protocols at the property.

- Data Comparison: No significant changes occurred since the last survey.

- Opportunity: Nearly 70% WANT to know the status of of local restaurants, but just 35% of consumers have received this.

- Resource: We’ve covered some ideas on how to convey this information.

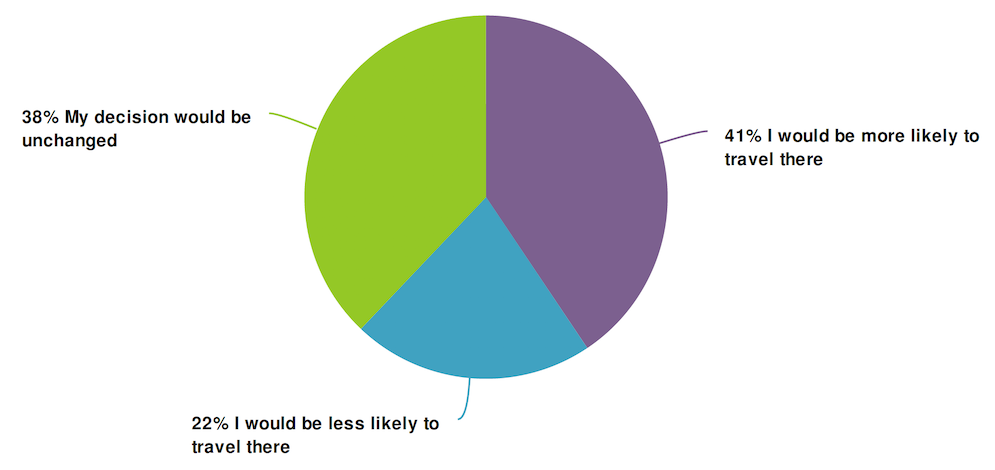

9. If your desired destination implements a mandatory face mask ordinance, how willthis impact your travel plans?

- Observation: We have shifted, yet again, with the results of this question. “I would be more likely to travel there” has taken over 41% of responses.

- Data Comparison: This question has shown the most volatility of all questions, since we started asking it. Those voting positively for mask ordinances increased from 35% since the last survey, to 41%. Those with unchanged decisions increased from 35% to 38%. Those less likely to travel decreased from 30% to 22%. This is after a substantial increase on the last survey, increasing from 19%.

- Opportunity: It is important that your property take a stand on this issue, and follow through. Being clear in your expectations of guests’ behavior rather than being wishy-washy, and enforcing those expectations is important, as we saw previously from those who have traveled this year.

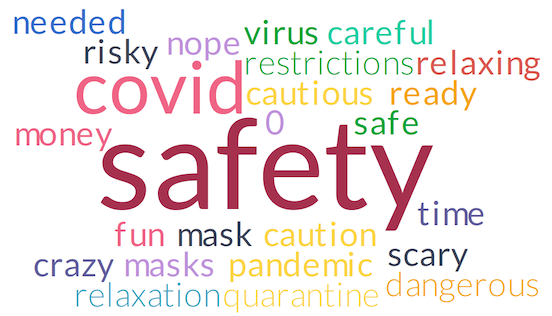

10. What is the first word that you think of when considering travel right now?

- Observation: “Safety” remains the most popular word.

- Data Comparison: “Mask” and “masks” continue to appear here. “Fun” has returned again. “Unsafe” does NOT appear this time.

- Opportunity: People are concerned for their safety above all, but they are also craving relaxation. What can you do to ease their mind about traveling to your property, with their budget concerns in mind?

11. Which of the following would most likely persuade you to book a future vacation during the coronavirus outbreak? (Check all that apply)

- Observation: Over 70% of people chose flexibility to change without penalty.

- Data Comparison: People saying that they could not be persuaded remained steady, at 16%.Discounts on stays and reassurance of extra sanitizing continue to be extremely close in the #2-3 spots.

- Resource: Fuel put this article together on what types of policy changes and messaging you should be implementing right now: The Definitive Guide To COVID19 Policy Updates & Communication.

12. Pick the top 3 reasons that would prevent you from staying at a hotel right now.

- Observation: Fear of other guests interactions remains the top concern, with nearly 35% of respondent votes.

- Data Comparison: “Nothing is preventing me” remained in the #2 position, with 28% of respondent votes. Fear of the common area has dropped into the #5 position, where it had previously been in the #2 position until the last survey.

- Opportunity: Be clear with all of your messaging and website information as it pertains to the cleaning procedures on property. Additionally, communicating the status of property amenities, and area attractions and restaurants is extremely important. If your primary consumer is those with children, being mindful of their budget concerns will also be important.

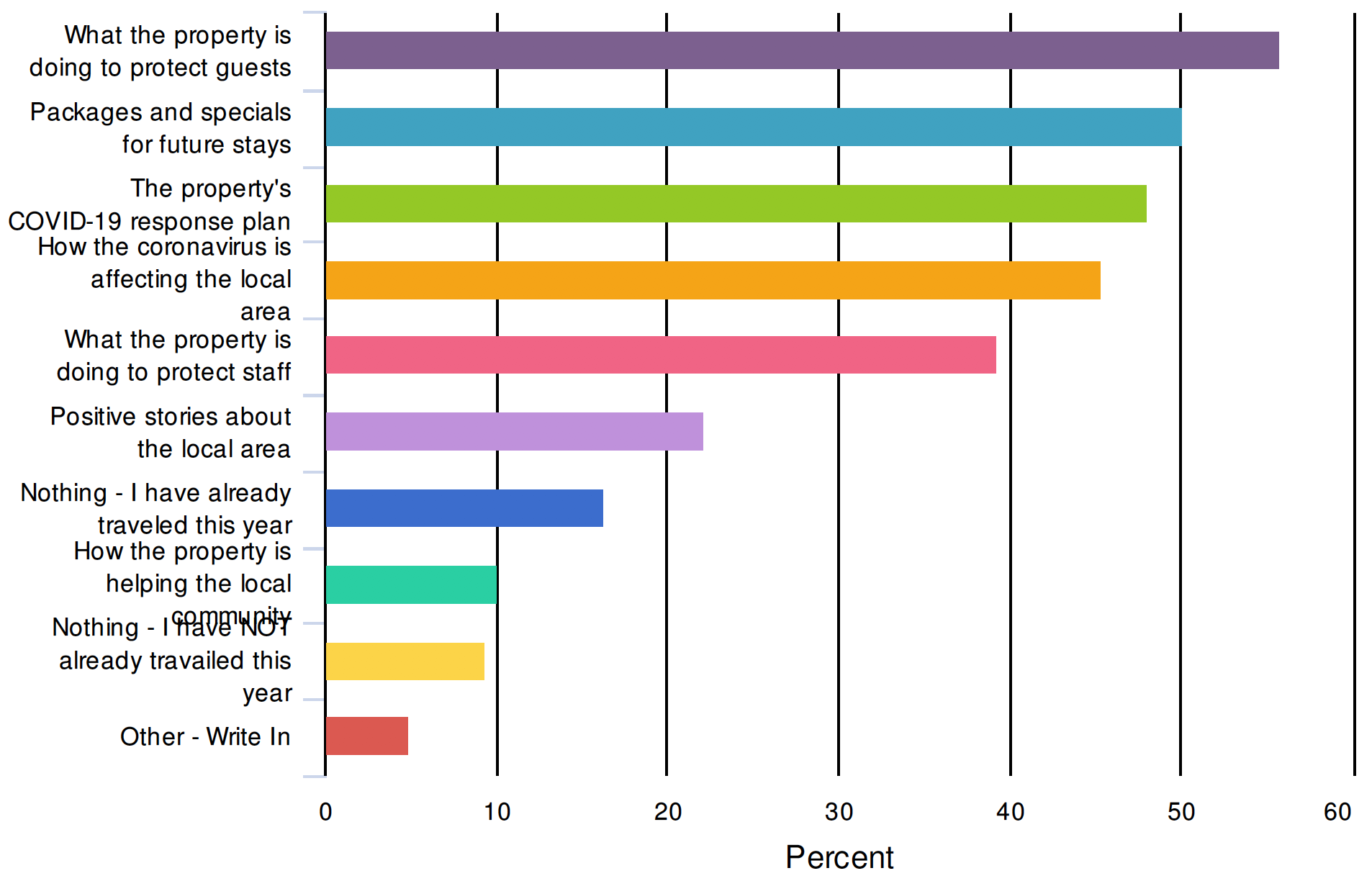

13. I would like to hear from hotels on the following topics: (check all that apply)

- Observation: Respondents continue to be more interested in learning about what properties are doing to protect guests than they are about receiving deals for future stays.

- Data Comparison: Most data has had very little shift since the last survey. However, those saying that they don’t want to hear from hotels even though they haven’t traveled decreased, again, from 11% to 9%.

- Opportunity: For those consumers that want to hear from hotels, sending messaging with important information on their safety AND that provides value to them, and shows empathy, can keep your property top of mind.

- Resource: Having the right CRM system is critical to this success. Find out how to determine if you are ready for a new one, and for the best strategies for using your system to its fullest ability. Your CRM System Will Determine How (and if) Your Hotel Recovers From COVID-19

- Additionally, learn how to “hunt” those people who are open to hearing from you.

14. How would the following hotel protocols increase your confidence in staying at aproperty?

- Observation: Deep cleaning between guests, and placing the sanitized remote in a sealed bag had the biggest impact, with 66% saying deep cleaning would greatly impact confidence, and 50% for the remote.

- Data Comparison: There weren’t any major shifts in data since the last survey.

- Opportunity: Be crystal clear in your communication to guests and potential guests about cleaning protocols. Additionally, with the remote having such a strong response, if you are able to incorporate this small item into your operations, it would be of great value to guests.

15. How likely are you to book a trip:

- Observation: 55% of respondents answered “maybe” or higher within the next 30 days. 60% responded for the next 60 days, and 64% for 90 days.

- Data Comparison: Those answering at least “maybe” in the next 30 days, remained unchanged, at 55%. When we first asked this question on April 16, 37% responded at least maybe.

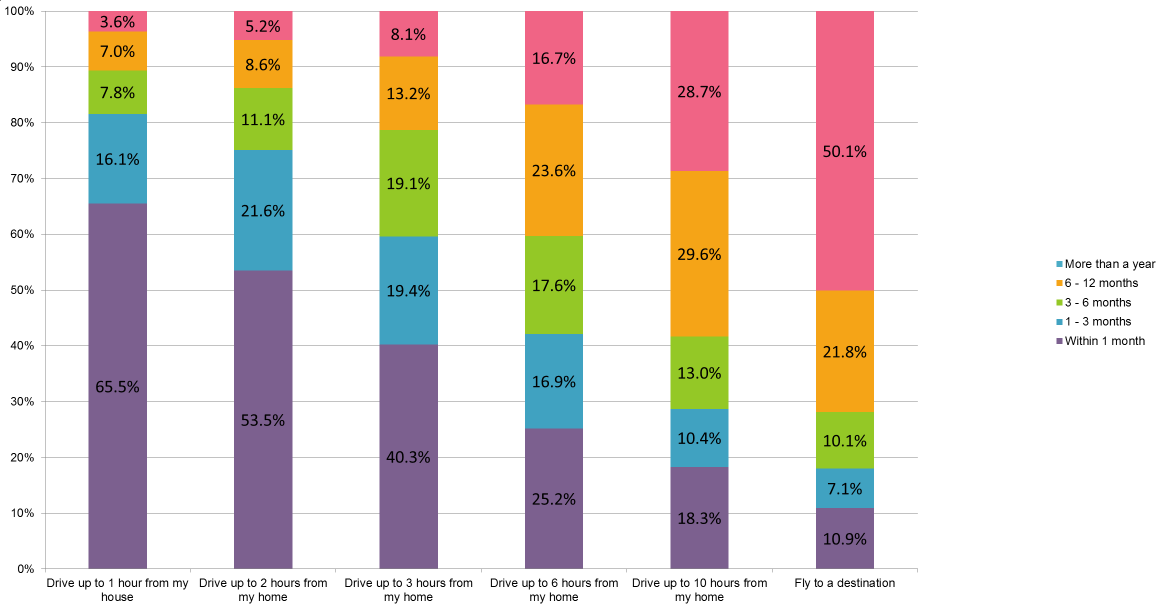

16. How soon will you be willing to make the following trips?

- Observation: Those willing to drive up to an hour from home within 1 month was at 66%, 2 hours, was 54%, and 3 hours was at 40%.

- Data Comparison: There were no substantial changes in data since the last survey.

- Opportunity: The 1-3 hour drive market remains the most confident for traveling sooner rather than later. For the near future, targeting these consumers via email and paid search will yield the best returns.

- Resource: Fuel has developed A How-To Guide For Targeting Drive Markets

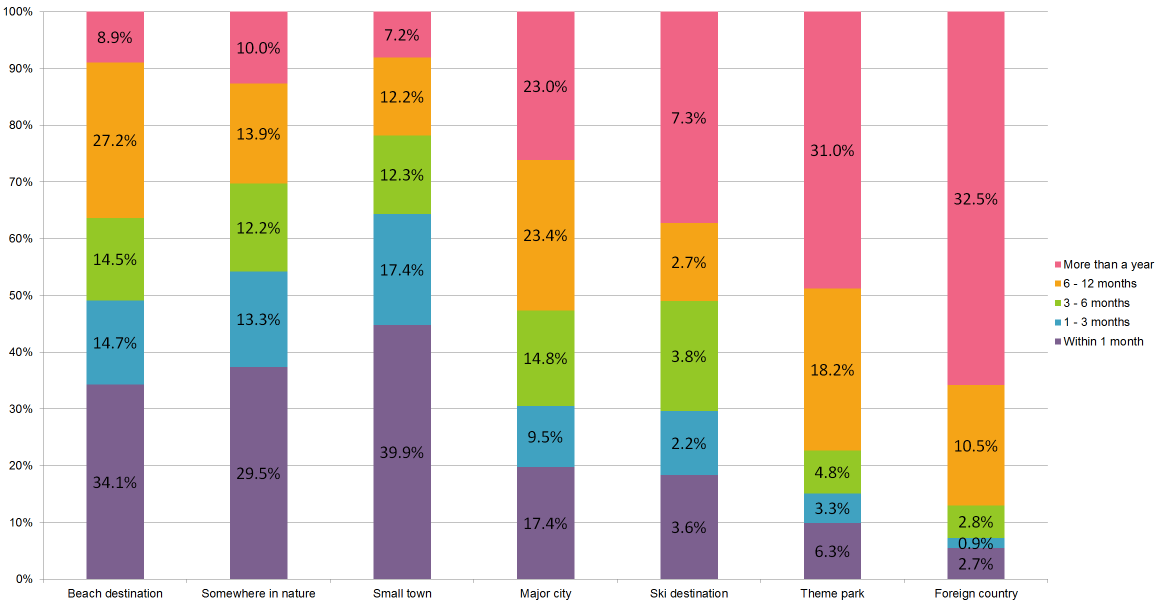

17. How soon will you be willing to travel to the following types of destination?

- Observation: Destinations with opens spaces continue to far more likely to be visited earlier than densely populated areas, or high-touch destinations. The small town category has continued to grow in popularity, now outpacing the beach and other places in nature.

- Data comparison: There was no significant change in data since the last survey.

18. Complete the following sentence: I will travel when:

- Observation: “Feel safe” is most prevalent since we first asked this question. Phrases relating to a vaccine, number of virus cases declining have also been popular.

- Data Comparison: We did not see much change since the last survey. “Mask” and “masks” returned again. We are seeing “money” and “afford” again.

- Opportunity: As mentioned before, whatever you can do to assure visitors that you have their well-being as a priority will increase your chance in convincing them to stay with you. Being cognizant of the financial stress many people are feeling, and providing value-add items to packages where possible will help consumers feel more comfortable booking.

Wrapping it Up

Across the ten times we have sent out this survey, respondents have been consistently sending the same message: they care about their health safety. That said, people ARE traveling.

More than 50% of respondents have now traveled during the pandemic, and of those, 56% have traveled more than once. Continuing to make the most of the 1-3 hour drive market, including tactics to promote last-minute stays, is a must, since more than 40% of trips were booked within 2 weeks of arrival.

Properties need to be doing all they can to let potential guests know that they are looking out for everyone’s safety (which seems to be happening), as well as communicating information about the surrounding area (which seems to be where properties are lacking).

With most questions showing very little change since the last survey, perhaps this is the new normal…at least for a little while.

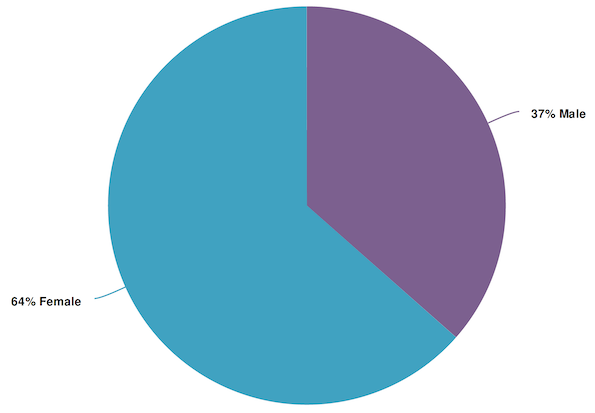

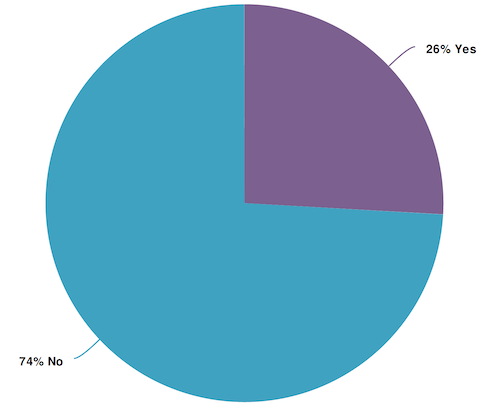

Survey MethodologyThis was a self-reporting survey sent to a database of leisure travelers located in North America. Questions containing multiple checkbox responses had the options randomized to avoid positional bias. 800 respondents completed all questions.

Below is the demographic breakdown of respondents.

Age & Gender:

Do you have children living at home with you?

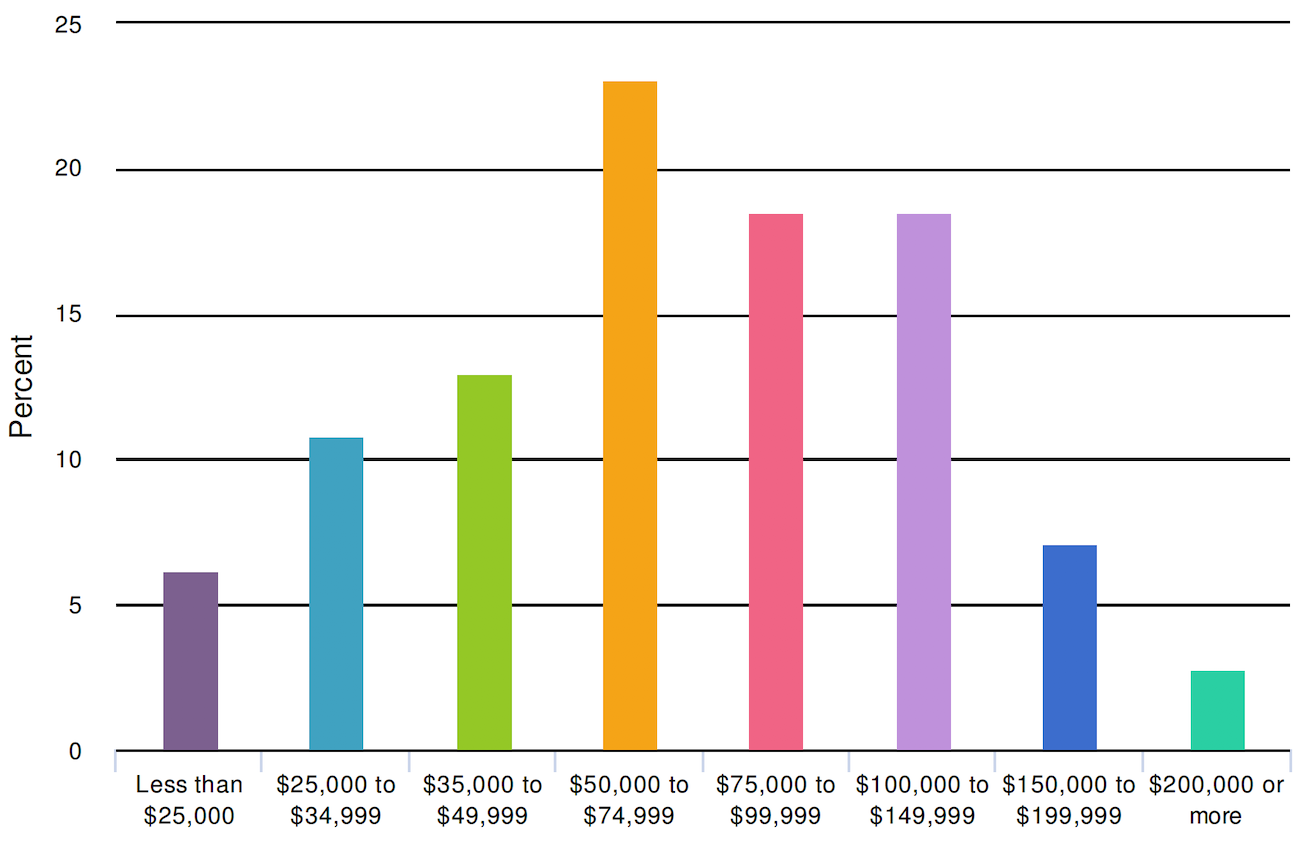

What was your total estimated household income before taxes during the past12 months?