Fuel COVID-19 Consumer Sentiment Study Volume 5: Guests’ Safety Will Dictate New Tech Needs

by Melissa Kavanagh

We hope that you find the information useful. The survey was sent out on May 28, 2020, and received more than 5,400 responses. Below is a summary of the findings, along with some observations and opportunities that arise from the results.

Executive Summary

We added several new forward-looking questions to the survey. New to this analysis is a gender breakdown, and a comparison of how Millennials think vs. the group as a whole . Below are the highlights:

- There are contradictory findings about on-property safety. Virus precautions remain at the top of the list of topics consumers want to hear about from hotels, and fear of interacting with other guests and common areas are the top reasons preventing people from traveling now. However, the most popular response to how people would prefer to check in is still at the front desk. A mobile app was still far more preferable to a kiosk in the lobby. Write-in responses from some questions ranged in sentiment from “I have no concerns about the virus” to wanting to ensure masks would be enforced.

- Looking at housekeeping preferences, responses were quite mixed, but more people said they would prefer housekeeping only when they request it.

- Millennials continue to be significantly more ready to travel in the near future, however, they are also more concerned about budgets. Additionally, they are more interested in using a mobile app to check in and open their rooms.

- Open air destinations and 2 hour drive locations are still far more likely to be visited in the near future.

1. What is the first word that you think of when considering travel right now?

- Observation: “Safety” continues to be the top word, again.

- Data Comparison: The various forms of “relax,” “fun,” and “freedom” have remained in this cloud since last survey, which are clear indications that people are feeling the effects of the restrictions of this pandemic. However, “money” and “price” have entered the cloud this time. These have both positive and negative connotations: either these are positive because they indicate that people ARE thinking about traveling and talking about budget items, OR they are negative because financial strain is weighing on these consumers.

- Opportunity: People are concerned for their safety above all, but they are also craving relaxation and freedom from their houses. What can you do to ease their mind about traveling to your property, with their budget concerns in mind?

2. Which of the following would most likely persuade you to book a future vacation during the coronavirus outbreak? (Check all that apply)

- Observation: Nearly 70% of people chose flexibility to change without penalty.

- Data Comparison: People saying that they could not be persuaded decreased for the fourth time, going from 21% to 19%.

- Opportunity: Clearly stating your cancellation policy and safety efforts, as well as any changes you have made to it in all marketing efforts is critical.

- Resource: Fuel put this article together on what types of policy changes and messaging you should be implementing right now: The Definitive Guide To COVID19 Policy Updates & Communication

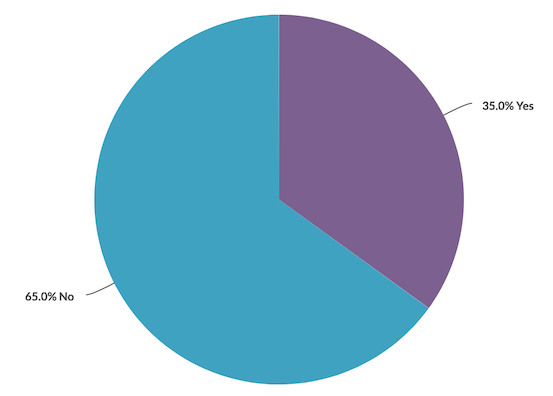

3. Have you already booked your future stay?

- Observation: 35% of people do have an upcoming stay, 65% do not.

- Data Comparison: These numbers have been slightly in flux over the last few surveys.

- Opportunity: Coupling this response with the previous insight shows that people WANT to travel and are feeling the need to get out of their houses. 65% of the population is a lot of untapped opportunity.

4. Pick the top 3 reasons that would prevent you from staying at a hotel right now.

- Observation: The two most popular answers are pertaining to close contact of people on-property. 50% chose fear of other guests interactions, and 42.5% said fear of the common areas. Though there still are 40% stating that budget is holding them back. There was a write-in option for this question, and many of those said, “none” or mentioned the area and/or amenities not being open.

- Age Insight: Millennials ranked budget concerns as their top reason, compared to #3 of the whole group.

- Opportunity: Be clear with all of your messaging and website information as it pertains to the cleaning procedures on property. Additionally, communicating the status of property amenities, and area attractions and restaurants is extremely important. If your primary consumer is those with children, being mindful of their budget concerns will also be important.

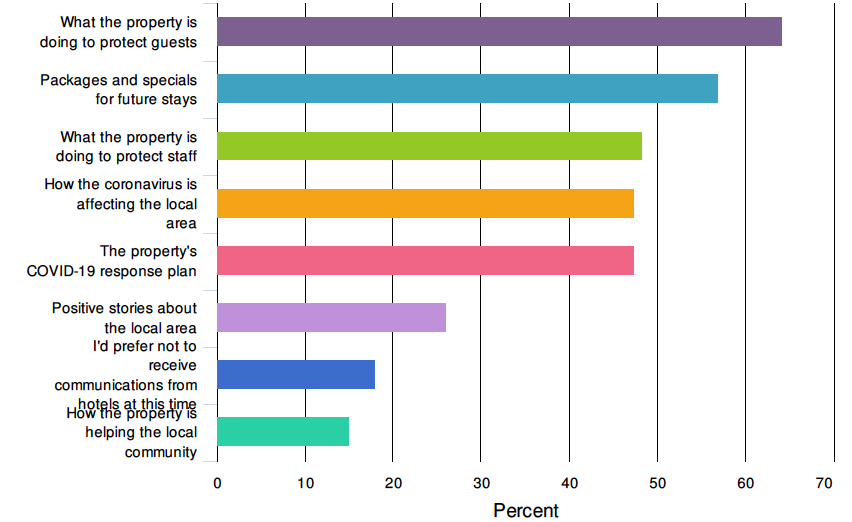

5. During the outbreak, I would like to hear from hotels on the following topics: (check all that apply)

- Observation: Respondents continue to be MORE interested in learning about what properties are doing to protect guests than they are about receiving deals for future stays. They are also interested in safety regarding the staff, what is happening in the local area, and the property’s COVID-19 response plan. There were many write-in responses to this question ranging from “I’m tired of hearing about COVID,” to “estimated occupancy,” and “if masks are required/highly recommended.”

- Data Comparison: Those saying they would not like to hear from hotels now has decreased again from 20% to 18%. Those choosing what the property is doing to protect guests increased for the fourth time, from 62% to 64%.

- Opportunity: By proactively messaging your guest database with important information on their safety AND that provides value to them, and shows empathy, you can keep your property top of mind. Being in communication with your guest during this time increases your chances of earning bookings as recovery picks up.

- Resource: Having the right CRM system is critical to this success. Find out how to determine if you are ready for a new one, and for the best strategies for using your system to its fullest ability. Your CRM System Will Determine How (and if) Your Hotel Recovers From COVID-19

6. How likely are you to book a trip:

- Observation: There is growing confidence to book a trip in the next 30 days, with 54% responding “maybe” or higher, 66% within 60 days, and 79% within the next 90 days.

- Data Comparison: Those answering at least “maybe” in the next 30 days increased from 50% to 54%. When we first asked this question on April 16, just 37% responded at least maybe.

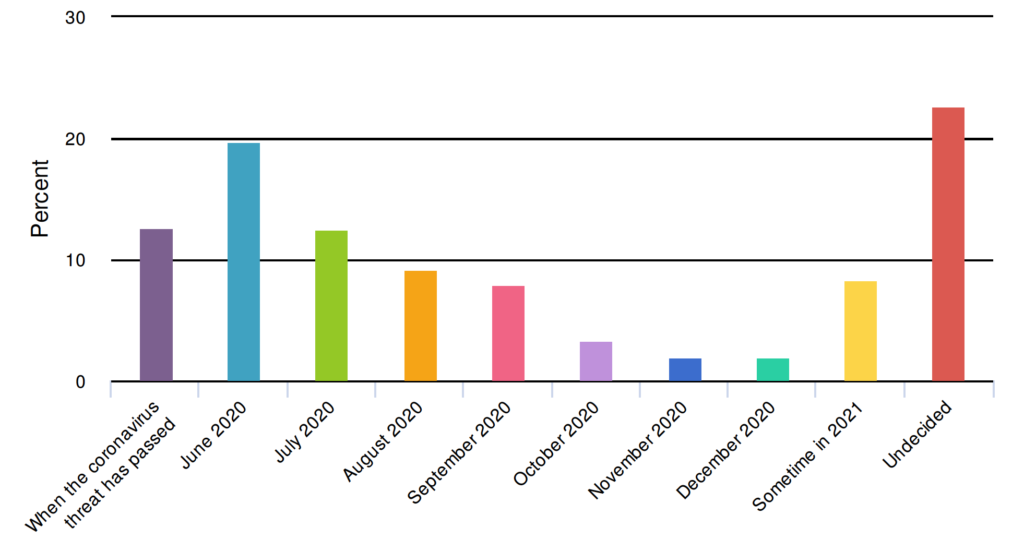

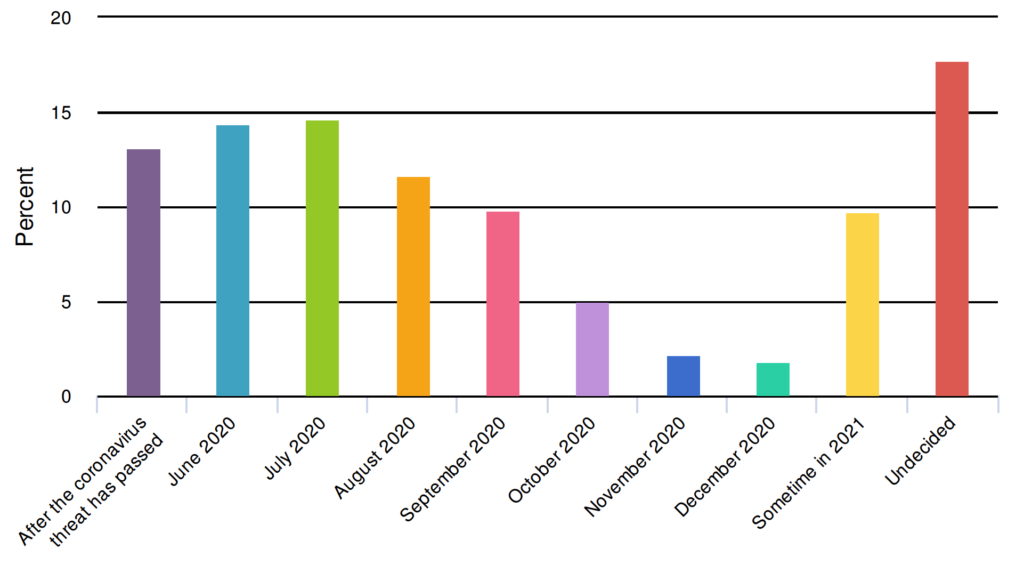

7. When do you intend to BOOK your future vacation? & When do you intend to TRAVEL for your future vacation?

BOOK

TRAVEL

- Observation: For booking, 12% said after the virus has passed, 21% were undecided. Sometime in 2021 was chosen by 8%. Of those that chose a 2020 date, June was most popular, at 19%, followed by July at 12%.

- For traveling, 17% were undecided. June and July were the most popular answer of those that chose a date, at 14% each.

- Data Comparison: For booking, “after the threat has passed” responses shrunk again from 18% to 12%. For travel, this response saw a decrease as well, going from 16% to 13%. However, those who are undecided to book increased from 18% to 21%, and travel increased from 14% to 17%.

- Opportunity: The continued decrease in those choosing to not make a decision until after the virus has passed indicates there is increased confidence that the pandemic is passing. However, there are still a fair amount of undecided travelers. Sending clear messaging about your property’s cancellation policies and safety procedures can help persuade consumers to book.

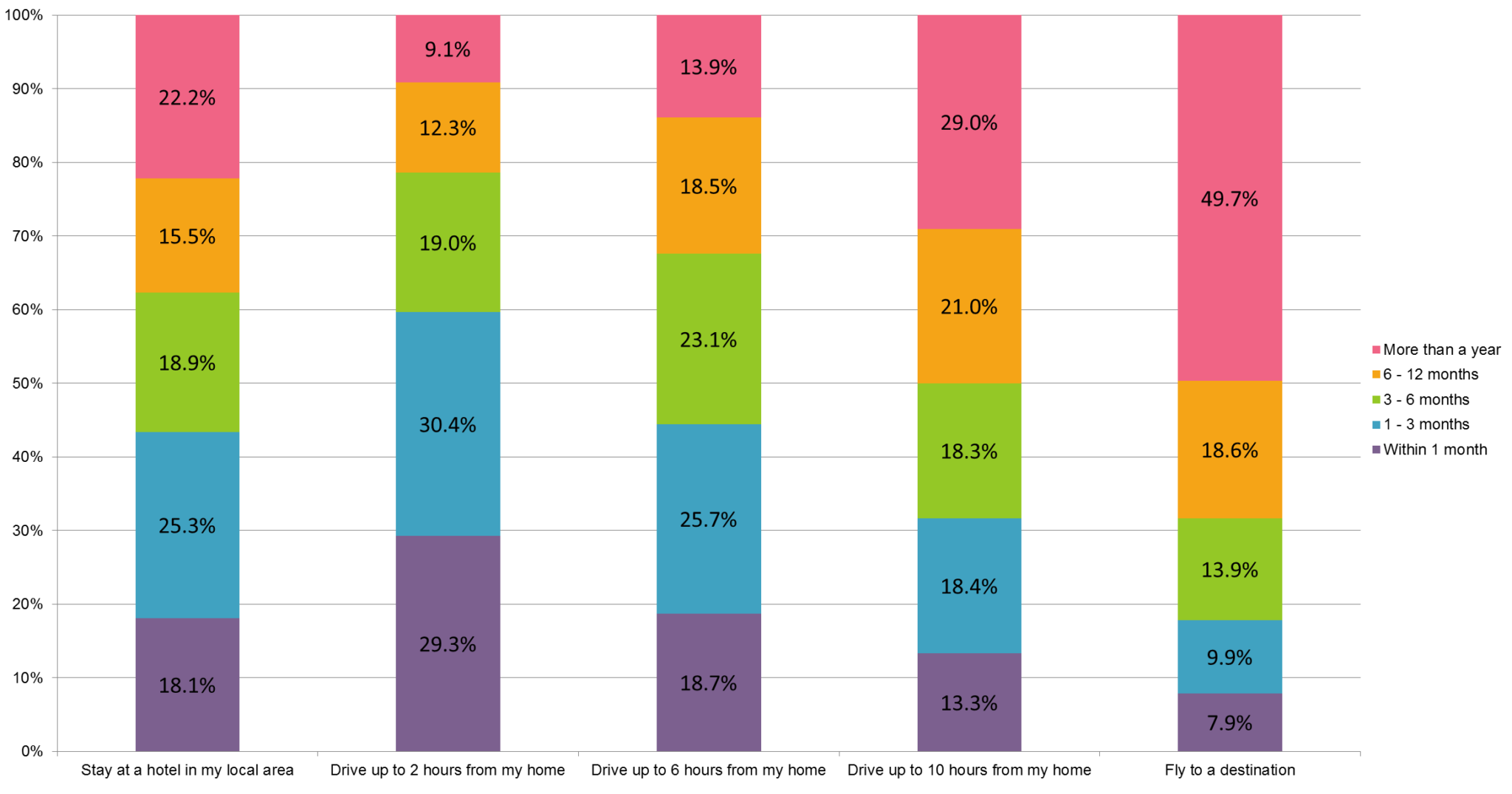

8. How soon will you be willing to make the following trips?

- Observation: For distances of driving up to 2 hours, 60% of consumers will be ready to travel within 3 months, with 29% willing to travel within 1 month. Staying local was at 43% within 3 months, driving up to 6 hours was at 44%, and flying comprised just 18%.

- Age Insight: Millennials continue to show they are much more willing to travel sooner than the rest of the population. 38% will be ready to drive within 2 hours of home within a month.

- Data Comparison: We changed the wording on this question. Previously the question specified “after restrictions have been lifted.” This may be affecting the decrease we are seeing across all categories of those willing to travel within 1 month.

- The 2 hour drive category decreased from 34% to 29%

- Staying local decreased from 22% to 18%.

- Opportunity: The 2 hour drive market remains the most confident for traveling sooner rather than later. For the near future, targeting these consumers via email and paid search will yield the best returns.

- Resource: Fuel has developed A How-To Guide For Targeting Drive Markets

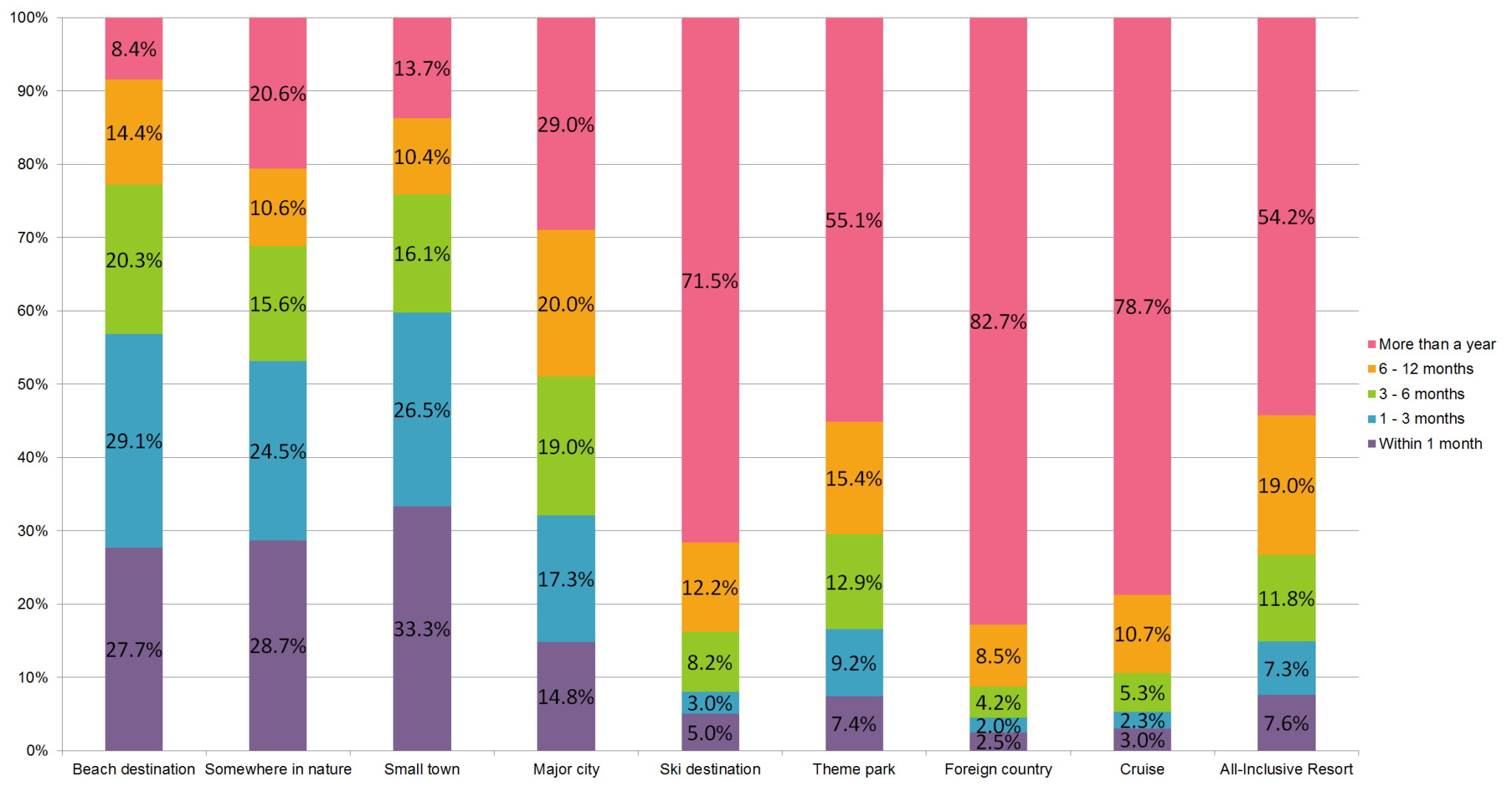

9. How soon will you be willing to travel to the following types of destination?

- Observation: Destinations with opens spaces are still far more likely to be visited earlier than densely populated areas, or high-touch destinations.

- Age Insight: Millennials voted 40-47% willing to travel to a beach destination, nature or small town within 1 month.

- Data comparison: This question had the same change in wording, removing “after restrictions have been lifted.” We see similar decreases across all destination types within 1 month. Beach destinations decreased from 30% to 28%. Somewhere in nature decreased from 33% to 29%. Theme parks have now decreased to 7%.

- Opportunity: We are already seeing an influx in bookings in beach destinations as they have opened. All destinations need to be ready for this when the area opens up.

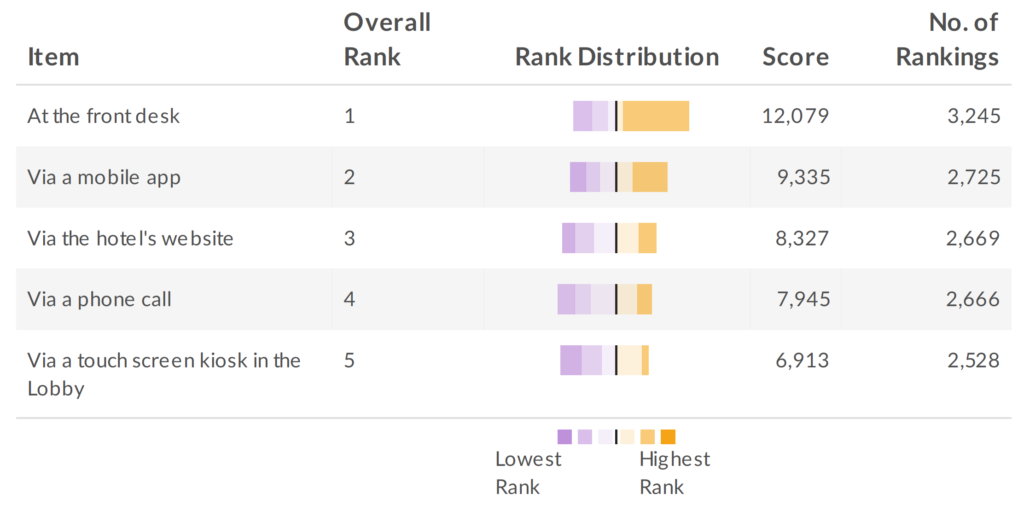

10. Given the option, rank in order how you would most like to check-in for your next vacation?

- Observation: SHOCKINGLY, “at the front desk” was ranked first. A mobile app was far more preferred to a kiosk in the lobby.

- Gender Breakdown: Males ranked checking in on the website higher than using a mobile app.

- Age Insight: Millennials were more inclined to check in via an app vs. the front desk.

- Opportunity: Safety (and the perception of it) at your front desk will be critical to keeping customers comfortable. Having a mobile app that allows for a reduced-contact check-in would be very valuable to a large percentage of consumers.

- Resource: Here is some information on a potential mobile app for your hotel.

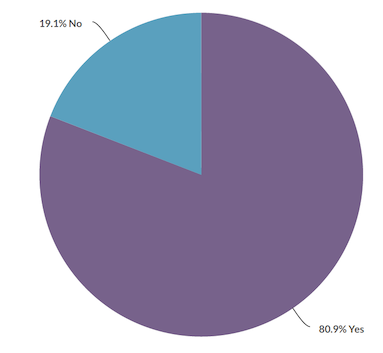

11. Would you be willing to use a hotel's mobile app to check-in to your hotel?

- Observation: An overwhelming, resounding “yes” from 81% of respondents.

- Gender Breakdown: Consistent with the data above, just 71% of males said yes.

- Age Insight: 89% of Millennials voted yes.

- Opportunity: Coupling this data with the data from the earlier check-in question, now is the time to invest in a mobile app that allows guests to remotely check in. An app that simply frames in your website is of no use. The app needs great functionality, with mobile check in and check out. Not to mention the ability to communicate with guests while on property, further reducing the need to interact with the front-desk.

12. Would you be willing to use a hotel's mobile app to unlock your room?

- Observation: The responses here were closer than expected, given the response to the question about checking in via an app. That said, we are still looking at the majority of consumers saying yes to unlocking their room via an app.

- Age Insight: Based on the previous question, we are not surprised by the large discrepancy here as well: 72% of Millennials said yes, vs. 60% of the group as a whole.

- Opportunity: Is now the time to invest in lock technology that will move you forward into the realm of a contactless check-in? The desire for this technology by consumers is only going to increase over time, especially as the younger generation ages and travels more.

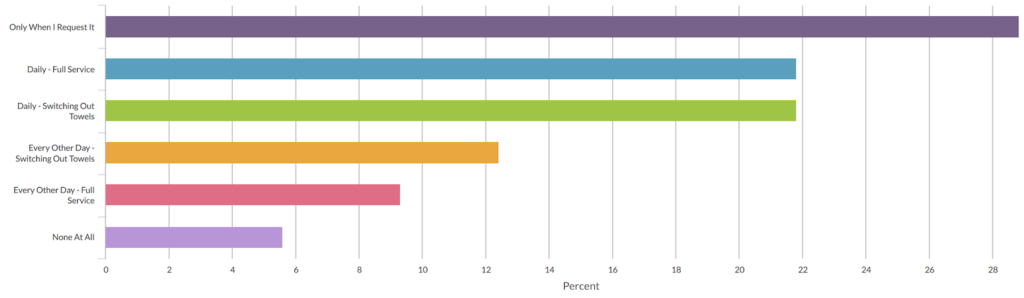

13. For your next vacation, what level of house keeping would you prefer?

- Observation: Responses were quite diverse, however, the most popular response was “only when requested,” at 29%. 22% still want daily, full service, and another 22% would like daily towel changes.

- Age Insight: Millennials had an even larger percentage of “only when I request it,” at 35%.

- Opportunity: If you haven’t already, this is time to re-think housekeeping procedures entirely. Will you cut down to “by request only?” Will daily housekeeping be an up-charge?

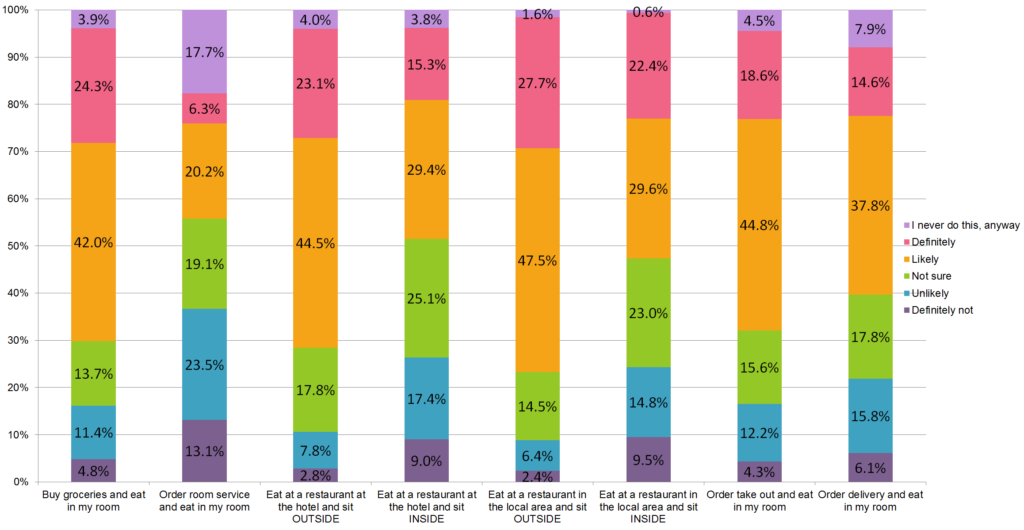

14. During your next vacation how likely are you to do the following?

- Observation: Respondents voted that eating on property and at local restaurants OUTSIDE was far more favorable to eating at those places inside. However, there was some positive movement for those saying yes to inside eating.

- Data Comparison: We added a new choice of “I would not normally do this” on this round of the survey, which does impact the percentages (most likely the “definitely not” option), particularly for room service. Room service had the highest percentage of respondents that don’t normally partake in that type of dining, at 18%.

- We did see an increase in those saying likely or very likely for indoor options: on-property restaurant increased from 40% to 44%; local restaurant increased from to 50% to 52%

- Age Insight: Millennials voting “definitely” to indoor restaurants were several percentage points higher than the whole group.

- Opportunity: If you have an on-property restaurant, promoting outdoor seating will be a large benefit. Additionally, with consumers being nearly as likely to buy groceries to eat in their rooms, properties that have rooms with kitchens have a huge advantage. Showcasing those kitchens is imperative now.

15. Complete the following sentence: I will travel when:

- Observation: Safety is most prevalent since we first asked this question.

- Data Comparison: “Restaurants” and “beach” have dropped off this cloud, though we do see “open.” This time we see “afford” and “money,” similar to what we saw in word cloud asking about traveling now. Finances may be becoming more of an issue, the longer the lock-downs continue in many areas.

- Opportunity: As mentioned before, whatever you can do to assure visitors that you have their well-being as a priority will increase your chance in convincing them to stay with you. Messaging around your restaurant should be included in your list. Being cognizant of the financial stress many people are feeling, and providing value-add items to packages where possible will help consumers feel more comfortable booking.

Wrapping it Up

One thing has been consistent since our first study was completed 2 months ago: people of all ages, gender, and income level are concerned for their safety. While the U.S. continues to lift stay-at-home restrictions, the ability for hotels to ease the safety concerns of potential guests is critical to the recovery efforts. Now is the time to invest your physical and financial resources into making sure your standard operating procedures will meet consumer expectations, and that your technology stack supports your marketing and operational needs. That may mean plexiglass dividers at the front desk, or utilizing a mobile app for check-in, or evaluating your CRM system to ensure that you are communicating with your guests and potential guests in the most effective way.

The desire to travel has not diminished. Hotels need to harness pent up demand for family travel. Those who can do this in an effective way will come out on top.

Survey Methodology

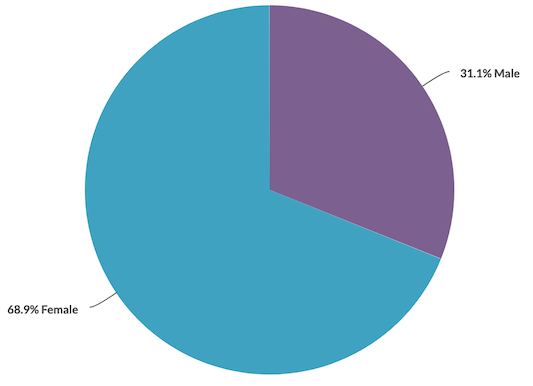

This was a self-reporting survey sent to a database of leisure travelers located in North America. Questions containing multiple checkbox responses had the options randomized to avoid positional bias. Over 4,000 respondents completed all questions. Below is the demographic breakdown of respondents.

Age & Gender:

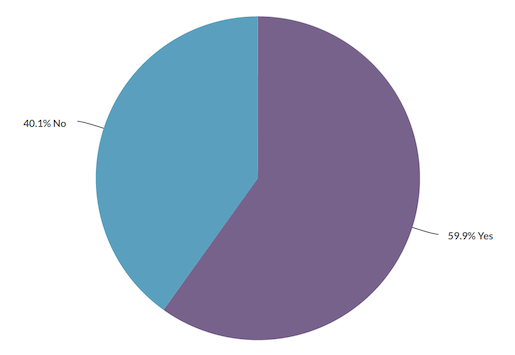

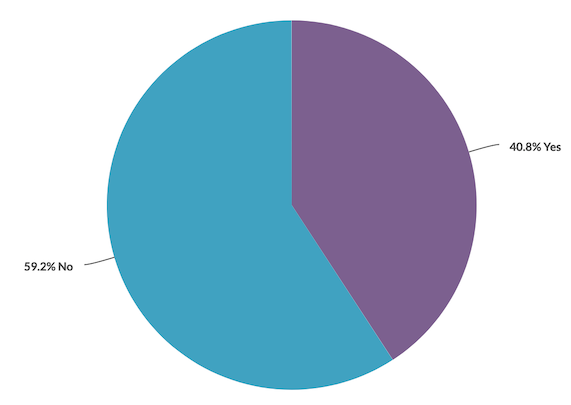

Do you have children living at home with you?

What was your total estimated household income before taxes during the past

12 months?